No Blockchains on a Dead Planet

«We are fighting huge battles in all sectors of our economy to tackle climate change. (…) And suddenly a technology appears that consumes an enormous amount of energy (…). I haven’t heard that it solves any real-world problem or caters to basic needs (…) in the climate movement, we just laugh about it» Pauline Brünger, Activist with Fridays for Future Germany (BUND, 2022)

Blockchain technology has been around nearly as long as the iPhone, longer than Windows 7 or the Google Chrome browser. Still, it is often discussed as a supposedly revolutionary futuristic tool for manipulation-free policy enforcement. It promises absolute decentralised transparency, independence from Big Tech, a revolution of the financial system, and the digitalisation of contracts and assets.

///<quote>

Blockchain technology promises

absolute decentralised transparency,

independence from Big Tech,

a revolution of the financial system,and the digitalisation

of contracts and assets.

///</quote>

The opposing critiques are even more passionate: the unequal distribution of power in the cryptocurrency community1, human rights violations, and especially the negative climate impact. Two successful panels of the Bits & Bäume Conference connected digital and environmental civil society actors to discuss the topic, showing the importance of a joint critique (Rehak, 2022; BUND 2022). This article highlights the main criticisms of blockchain technology.

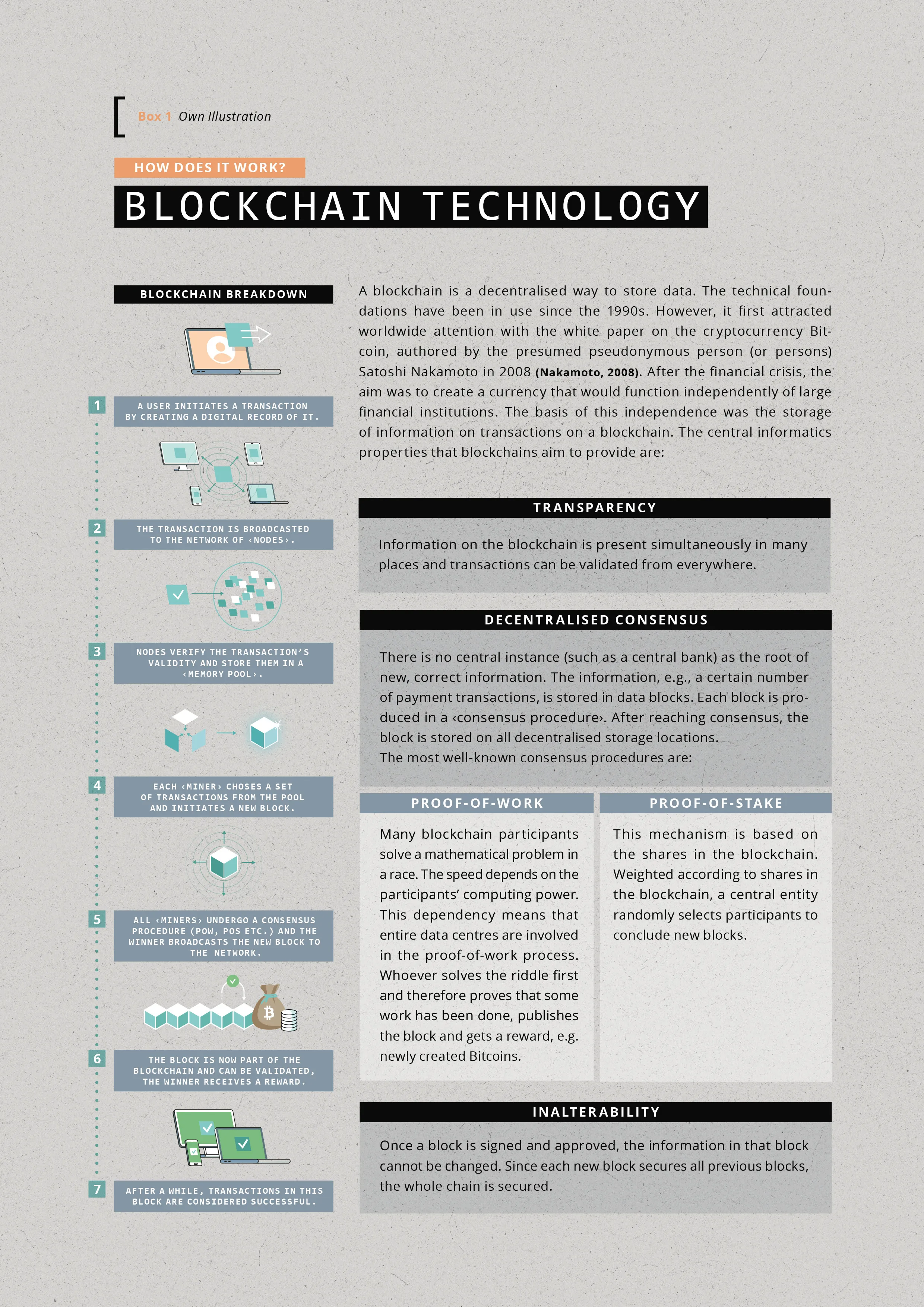

1Cryptocurrencies store transactions on a blockchain. Like an accounting book, the blockchain keeps track of the transactions [Box1].

Environmental impact of the blockchain technology

A blockchain is based on simple technical principles that can be used and programmed with basic informatics skills. Therefore, there is no comprehensive overview of the application areas of blockchain technology. However, the biggest blockchain uses, based on their energy consumption, are cryptocurrencies, especially Bitcoin and Ethereum (CBECI, 2022).

Although CO2 emissions of cryptocurrencies are widely known to be high, estimates of the related energy consumption are rough, with broad estimates that cryptocurrencies account for 25% of global data centre power consumption (Hintemann and Hinterholzer, 2021). For 2021, most sources estimate the annual energy consumption of the Bitcoin system alone at 131 TWh/year (CBECI, 2022), producing yearly emissions responsible for about 19,000 future climate deaths (Turby et al., 2022).

The second environmental impact of blockchains is the high resource consumption of the hardware required for the computing power. To compete in the proof-of-work process [see Box 1], chips have to be replaced every 1.5 years by the next generation (Ramesohl et al., 2021).

The production of these chips requires various newly mined raw materials (BUND, 2021), and reusing the highly specialised chips is often impossible. Mining these raw materials often causes environmental damage and human rights violations. It is estimated that every Bitcoin transaction equals more than half an iPhone in electronic waste (Ramesohl et al., 2021). There are different ways to tackle the problem of high-energy consumption and environmental impacts. One prominent policy suggestion is the use of renewable energy for the computing power of the ‹proof-of-work process› [see Box 1]. However, two thirds of cryptocurrency miners’ costs are related to energy consumption. Therefore, the miners often rely on cheap fossil energy (de Vries, 2019). The most prominent example is the re-commissioning of coal-fired power plants for mining bitcoins in New York and Montana (Spegele and Ostroff, 2021). In addition, renewable energies make up only 29% of the global electricity mix and their use is therefore limited (International Energy Agency, 2022).

Another option is to change the blockchain consensus process [see Box 1]. This change makes the technology more climate- and resource-friendly. In mid-2022, the second-largest cryptocurrency, Ethereum, switched to the ‹proof-of-stake process›: Consensus is no longer determined on the basis of computing power but according to the share in the blockchain. Resultingly, Ethereum’s energy consumption dropped by over 99%, and resource consumption is also estimated to have dropped rapidly as most mining devices have become obsolete (Turby et al., 2022). This change makes the system more environmentally friendly but the consensus process becomes more exclusive: To participate in the consensus process, users had to own 32 ether, equivalent to 38,000 € in December 2022. In addition, the cryptocurrency system now has a central gatekeeper again.

lack of real-world applications and the issue of power and inequality

Environmental impact aside, an increasing number of reports have questioned the benefits of blockchains. Although the word ‹blockchain› appeared 23 times in the

2018 German government digital strategy, the new 2022 strategy completely ignores blockchains as a tool. This omission could be due to the many ambitious government projects that were supposed to be implemented with blockchains but which failed due to violation of privacy rights or a lack of practicability.2 Evaluating the efforts of German start-ups and the private sector, a report by the German ICT industry association, Bitkom, concludes: «There is a lack […] of examples on the market of successfully implemented Blockchain applications [besides cryptocurrencies]» (Bitkom, 2019).

2Prominent examples are the attempt to store vaccination records during the Covid19 pandemic on a blockchain (Biselli, 2020), the failed implementation of blockchain-based drivers licences and ID (Biselli, 2021) and the much criticised project FLORA, which attempts to store migration data on a blockchain (BiselliandKöver, 2019)

Globally, one of the most notable applications of blockchains in the public sector is the introduction of Bitcoin as a means of payment in El Salvador. Although expectations were high, most El Salvadorians did not use Bitcoins due to the cryptocurrency’s high volatility (Sigalos and Kharpal, 2022). This lack of use highlights the elephant in the cryptocurrency room: Bitcoins are not useful as a means of payment; they are more suited to financial speculation.

///<quote>

Cryptocurrencies and

related blockchain-based

financial products

are a zero-sum game.

///</quote>

Cryptocurrencies and related blockchain-based financial products are a zero-sum game: «Any money anyone wants to pull out, someone else has to put in» (tante, 2022). Users with particularly large amounts of cryptocurrency are motivated to bring new people with real money into the system, but private investors who invest too late lose most of their money. Accusations of cryptocurrencies being a Ponzi scheme are increasing, often due to examples such as the crash of the crypto exchange Bitconnect, the fraud of the crypto exchange FTX, and the crypto crash in early 2022.

///<quote>

Participants have no means

of democratically controlling

or influencing

the cryptocurrency system.

///</quote>

These examples also show the problematic distribution of power and wealth in the cryptocurrency system: Participants have no means of democratically controlling or influencing the cryptocurrency system. Power in the system depends on the amount of money or computing power users can invest (Rehak, 2019). The inequality in the system becomes clear when considering that 100 users own 17.3% of all Bitcoins. In the case of Ether, this figure is 40% (Kharif, 2017).

Conclusion

Although politicians, start-ups, and established companies have spent the past years highlighting the disruptive potential of blockchain technology, until today it has not met these expectations. Besides cryptocurrencies, no other public or private sector use case has proven to be widely successful or useful. Furthermore, the biggest use cases keep destroying the environment. Although implementing the proof-of-stake-process in the Ethereum blockchain lowered both emissions and raw material usage, there remains a tendency to increase power imbalances in the crypto system, promoting wealthy users and raising the question whether cryptocurrencies hold up their promise of being an egalitarian and decentral financial system or if they are just creating more inequality.

Next page